Va Financing

- Pick a beneficial Sr. Va Mortgage Professional

- Virtual assistant Financing Eligibility

- Very first time Virtual assistant Buyer

- How much House Do i need to Pay for?

- Calculate My Va Mortgage Commission

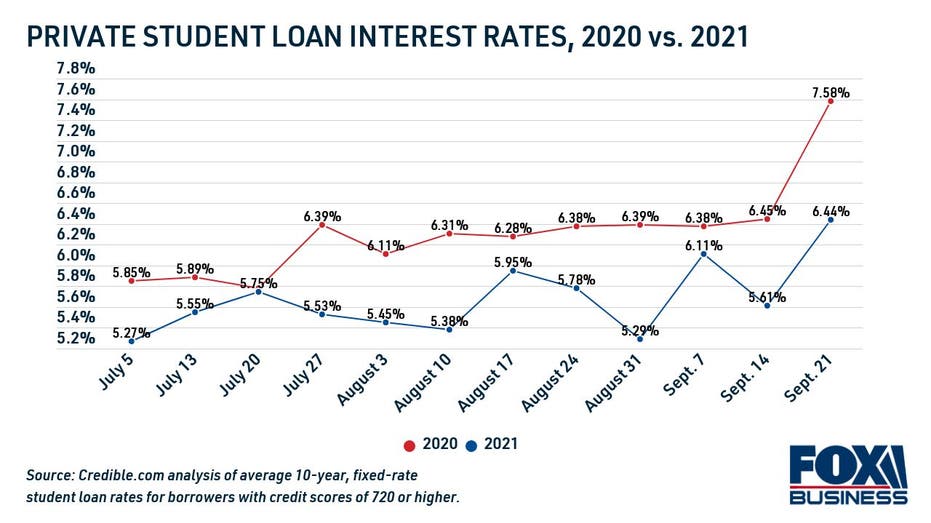

- Virtual assistant Mortgage Pricing

- Va Funds with Zero Settlement costs

A residential property To possess Veterans

- Select an experienced Amicable, Va Smart Agent

- Virtual assistant Consumers Apps

Virtual assistant Mortgage go to the website Rates As opposed to FHA Financing Rates: Which are Most useful?

Providing a home loan that have a decreased-interest rate could save you several thousand dollars along side lives of your financing. Each other Virtual assistant and FHA finance are notable for offering aggressive attention costs and are usually higher alternatives for basic-time homeowners. But what type is perfect to you personally? In order to choose, here’s a glance at the differences between both applications and you may a comparison from Virtual assistant financing prices instead of FHA mortgage pricing.

Va mortgage cost versus FHA mortgage costs: Which can be all the way down?

The interest rate you can purchase depends on a lot of things, such as the economy requirements, your income, as well as your credit rating. But basically, you can rating simply a somewhat better interest rate of the going with a keen FHA mortgage in the place of good Va financing. The difference is all about 0.25% in the payment, which means in the you to-sixteenth (0.0625) from inside the speed, so you probably will not even see unless you query a talented mortgage manager toward nitty-gritty info concerning your speed research.

Yet not, the major benefit of a beneficial Va financing vs an enthusiastic FHA loan ‘s the assessment out of charge is that you can pay less every times with a Va loan since it has no the newest month-to-month home loan insurance fees.

What is the difference between FHA and you will Virtual assistant financing applications?

Before you is right for you, there are a few key differences when considering FHA and you will Virtual assistant financing that you need to know about.

FHA loans wanted the absolute minimum advance payment away from 3.5%. Va finance, as well, don’t need a down-payment, leading them to a much better selection for people with reduced discounts.

One another FHA and you can Va loans can just only be used to pick top houses, perhaps not vacation residential property or local rental functions. Yet not, you ily family if you are planning to reside in certainly the latest systems.

FHA loans need you to shell out annual home loan insurance costs, being usually 0.85% of the financing harmony, paid down monthly.

That have a keen FHA loan, you’re going to have to spend an initial premium from the closure that’s equal to a single.75% of your own overall amount borrowed.

When you close on your own Virtual assistant loan, you’re going to be responsible for settling settlement costs to be paid back by the the vendor or bank or pay for your settlement costs. The newest closing costs tend to be good Virtual assistant funding fee which is equal to dos.30% of loan amount having very first-date pages of its Virtual assistant financing benefit.

With an enthusiastic FHA mortgage, you’ll have to shell out initial financial insurance and you will closing costs, being generally step three% so you’re able to cuatro% of the overall amount borrowed.

One another FHA and you will Va loans has actually personal debt-to-money proportion and you may credit score conditions which you can need certainly to meet to meet the requirements.

The newest FHA means individuals getting a credit history from from the least 500 and you will a personal debt-to-money proportion regarding 43% as approved for a financial loan.

The latest Virtual assistant doesn’t set the very least credit rating, but some lenders wanted borrowers getting a score from 620 or even more. Additionally, you will should have a personal debt-to-money ratio regarding 41%, some loan providers undertake highest rates. You’ll also must meet with the military service conditions.

And this loan sort of is best for your?

FHA funds are worth offered. not, Virtual assistant money are a great option for armed forces solution people. They give you low interest, reasonable costs, and the substitute for set no money down. Yet, if your credit is actually well lower than-mediocre and you are having difficulty getting recognized getting an effective Virtual assistant financing, think FHA as well. He is a great deal more flexible and you may reasonable than simply traditional funds.

Call 949-268-7742 to speak with our knowledgeable Va financing gurus during the SoCal Virtual assistant Homes today! Discover in case your Virtual assistant financing ‘s the proper choice for you.