As RBI features the brand new repo rates undamaged, predicated on masters, this might be a step throughout the proper assistance regarding helping do rising prices and easing challenges for the homebuyers.

To the , during the their bimonthly coverage speed conference, the new Put aside Financial of India (RBI) signed up to keep up the newest repo rate within six.5 per cent, the primary rate of interest employed for financing quick-identity financing so you’re able to commercial finance companies. Which feedback, was a student in range that have economists’ traditional. This new RBI has now remaining the standard interest rate unchanged to possess new 6th straight conference, affirming its hawkish coverage posture and appearing a prolonged age increased prices. RBI Governor Shaktikanta Das estimated one to rising cost of living perform mediocre cuatro.5 % on after that fiscal season starting in April, when you are detailing the new economy’s robust abilities, that have increases likely to started to eight percent during this time.

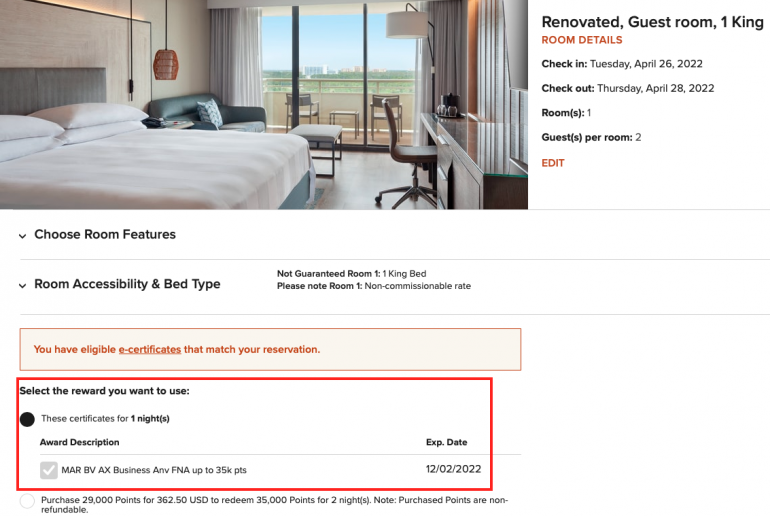

Offer

Experts translate the loans in Bristol choice to retain the repo price given that a keen extension of one’s earlier a couple of rules announcements’ positives, particularly for homebuyers. Thus, homeowners continue steadily to benefit from the advantageous asset of apparently reasonable mortgage rates.

Just what it Method for Homeowners: Anuj Puri, chairman, Anarock Class, a bona fide home supplier, said within the a statement, When we think about the expose manner, the fresh housing industry might have been burning, and you may undamaged mortgage costs will help take care of the full confident individual emotions. Since houses cost enjoys risen along the better seven metropolitan areas over the last year, that it breather because of the RBI is actually a distinct advantage to homebuyers.

Advertisement

Considering ANAROCK browse, 2023 watched average property rates rise from the anywhere between 10-24 % in the best eight towns, having Hyderabad recording the highest 24 percent jump. The average prices throughout these areas stood in the everything Rs 7,080 for each and every sq .. feet., whilst in 2022 it was up to Rs 6,150 for each sq .. base. a collaborative raise out-of 15 per cent.

Moving forward, we could anticipate the newest momentum in the property transformation to continue, significantly using intact repo costs which keeps home mortgage interest rates attractive and have code lingering robustness of India’s confident financial frame of mind, additional Puri.

Based on positives, The fresh new FM’s Budget 2024 message highlight the reasons trailing financial growth, such as the robust demand regarding the a home markets, particularly in the new large-prevent and you can deluxe avenues. Brand new government’s work at affordable construction, towards the statement out-of a special design of these way of living towards the lease, is anticipated to help you subscribe the general growth of the genuine estate business.

Amit Goyal, Handling Director, India Sotheby’s All over the world Realty, said inside the an announcement, The brand new advised design often subscribe a whole lot more homes advancements throughout the country, improving the actual property landscaping so you can newer levels. Also, with brand new money and entrepreneur-friendly principles, Asia have a tendency to witness more individuals become higher-net-worth people, which more likely to purchase a house.

Advertisement

Badal Yagnik Chief executive officer (CEO), Colliers Asia, a bona-fide property properties and you will money government company, said from inside the a statement, The fresh new government’s persistent emphasis on sensible property unveils all sorts of possibilities to own domestic developers, because they status themselves to make ample benefits, straightening to your wider sight regarding inclusive and you will accessible living. In the middle of positive field synergies when it comes to steady interest rates, glamorous incentives, and enhanced affordability, domestic people too are likely to resonate hopeful rely on into the the a home avenues.

Advertisement

Exactly what it Opportinity for Financial Consumers: This new RBI statement with the rates may come while the a relief to property owners who had been experiencing large interest rates and you can extended mortgage words. Anshuman Magazine, Chairman & Ceo – Asia, South-Eastern China, Middle east & Africa, CBRE, a professional a home and you may qualities organization, said, The choice to hold the repo price unchanged to your 6th straight big date is expected to own minimal affect the interest prices for lenders, delivering save to help you both current and you will potential individuals. The stability in the interest levels try poised to help you inspire potential housebuyers and empower builders in order to package and you can launch the plans with an increase of depend on. Brand new central bank’s choice to keep worried about brand new health-related detachment of one’s accommodative position does rein within the rising prices next.