A home loan system originally meant to refresh outlying groups will most likely not be will-made use of, nonetheless it yes comes with the positives. USDA finance – which are mortgages protected from the Us Company out-of Farming – have no deposit, shorter home loan insurance fees and you will low interest.

Nonetheless, the newest USDA secured merely 137,000 loans when you look at the 2020. That’s right up 38.9% compared to the year early in the day, however, USDA fund taken into account just 0.4% of the many mortgage interest last week.

The fresh restricted have fun with can be a bit stunning because of the extensive supply of this type of loans. Centered on Sam Sexauer, chairman out of home loan credit within Residents Financial within the Columbia, Mo., in the 97% away from You.S. landmass is largely USDA-qualified. Over 100 billion Us americans live-in qualified groups – of several discovered 31 kilometers otherwise shorter outside major metros.

It’s often considered that USDA money are merely to possess farms otherwise agricultural attributes, but that is incorrect, said Scott Fletcher, president from risk and you will conformity during the Fairway Separate Home loan, the big founder of USDA mortgages in the united kingdom. USDA funds need not be to have a ranch or keeps a big acreage is qualified.

Away from it really. People could explore USDA fund about suburbs – a location of many have flocked as pandemic began before last 12 months.

Having COVID resulting in a dash towards the suburbs, USDA finance are an excellent financing to possess capital a property, said Wayne Lacy, branch director and you will older mortgage inventor during the Cherry Creek Financial from inside the DeWitt, The state of michigan. They provide a reduced mix of personal home loan insurance coverage and down commission of all the mortgage choice, and build to acquire extremely sensible.

Preciselywhat are USDA loans?

USDA fund – often called outlying property money – was covered of the You.S. authorities, so much more especially this new USDA. The fresh new money have been established in 1991 to enhance and give so much more rural communities, but a big swath of the country is actually qualified.

The fresh USDA’s definition of rural’ is significantly wide than simply of many manage suppose, told you Ed Barry, President https://paydayloanalabama.com/vandiver/ of Financing Bank in Rockville, Md. Homebuyers usually dive towards end the areas or addresses these include offered commonly rural’ about old-fashioned feel, so they try not to actually read an effective USDA mortgage is a keen choice.

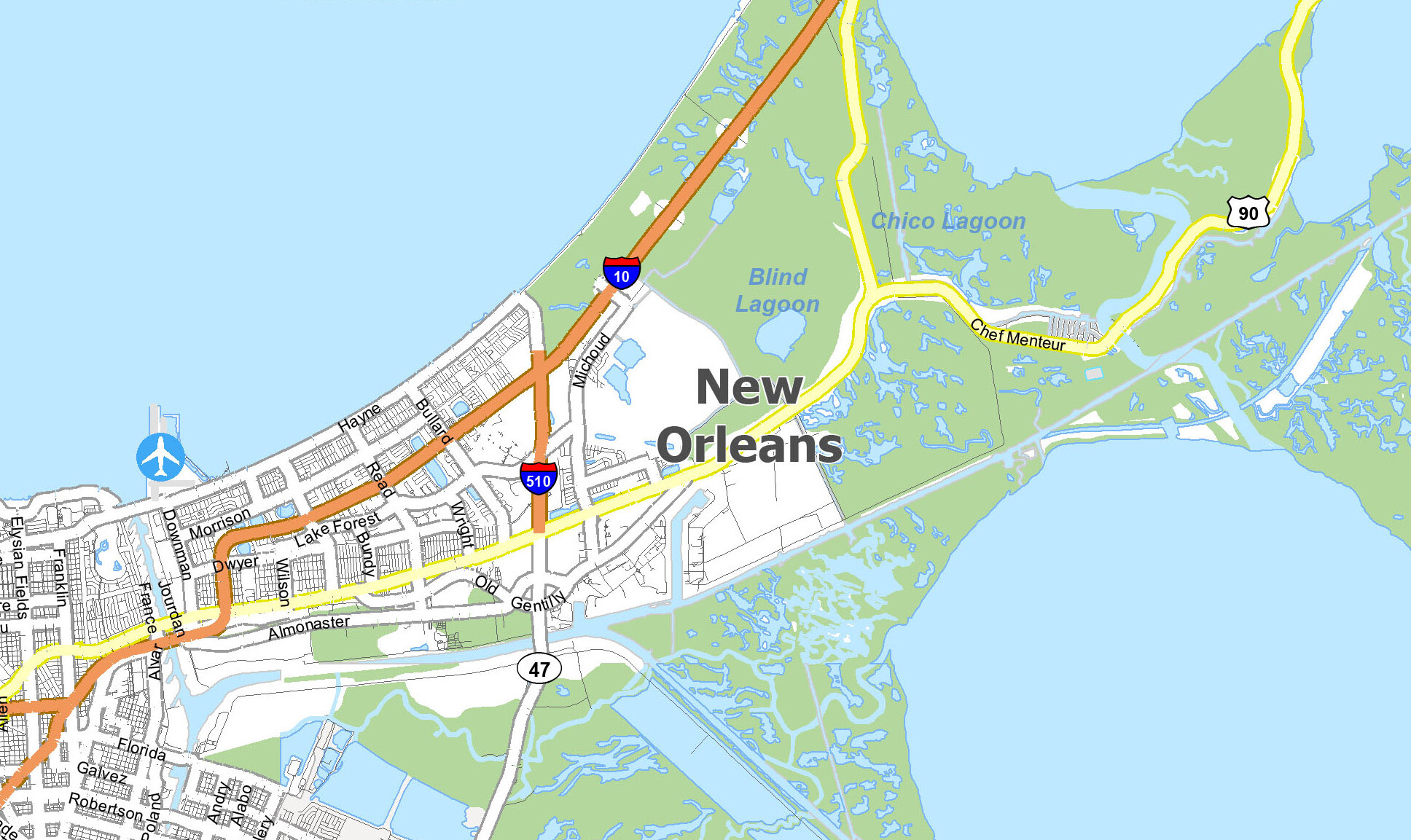

Consumers can be evaluate regional USDA availability when you go to the fresh department’s possessions qualifications equipment, plugging in the an address, and you will enjoying the fresh new USDA borders towards the chart. Overall, portion shady tangerine don’t meet the requirements. Such generally include big towns and cities in addition to their thicker, even more instant suburbs.

A good example ‘s the Houston city. Regardless if Houston correct is not entitled to USDA fund, many communities simply 30 kilometers aside was. This may involve locations such as for instance Cleveland, Crosby and also components of Katy – the big urban area for inward movements inside pandemic, based on an analysis from USPS changes-of-target investigation.

Why have fun with a beneficial USDA mortgage?

When you’re to get during the good USDA-qualified urban area, this type of reasonable-rates financing are worth said. For 1, they won’t need an advance payment – and that can imply big offers right off the bat.

The greatest cheer of your USDA loan is that there is zero requirement for a deposit, Sexauer told you. Away from Va mortgage, USDA money ‘s the merely 100% financial support option available. (Virtual assistant financing was kepted just for productive army users, pros and their partners, making them not available into the bulk of homeowners. However, the fresh Service out-of Pros Activities guaranteed a record step 1.2 mil mortgage brokers a year ago.)

To get an idea of exactly what a USDA loan helps you to save your, envision old-fashioned finance – the best version of mortgage in the industry. At minimum, traditional financing need at the least a 3% advance payment, or $15,000 to your $250,000 household. FHA finance wanted way more – from around step 3.5% so you’re able to 10% based on your credit score.