The fact examination of (TMA) now offers, on top of other things, the opportunity to browse the which social latest throughout the issue (monogamous family tools as well as uterine categories of polygynous belongings) as a familiar trend. Its extreme to investigate, among other things, exactly how stars in this Dagbon family relations structures food in using so it revolving named homes-dependent borrowing from the bank-the means to access software, particularly within polygynous homes considering uterine-families since the device. Inside economic literary works therefore, in which such as for instance a valuable asset might have been dully joined and you may assets rights secured, its felt a bonus for financial advancement and the efficient access to information . They functions as a method you to aids individual customers which have lowest dumps to track down loans from banks, making use of the collective property just like the defense because of their mortgages.

Up to now, but not, there have been zero empirical research for the northern Ghana to analyze the fresh new fictional character and you may implications of such intra-members of the family features in the property-established credit-usage of program. Earlier in the day education [25,twenty eight,47] keeps mostly looked precisely the ramifications of individuals trying to get borrowing from the bank which have individual titled possessions. This research thus causes this new literary works, of the interrogating the brand new strategies which this new extensive the means to access shared titled-nuclear-family-assets because a traditional plan fits into modern banking system, and its own implications for the family members just like the a beneficial product.

The fresh new strategic significance of a collective nearest and dearest advantage getting bound while the coverage to have payment out-of that loan is hence not not used to the conventional system when you look at the Ghana

The present day research and additionally changes because of the exceedingly analysing both the demand and gives side of the mortgage ong other things, the research assesses new advice out-of each other lenders (universal financial institutions) and you can consumers (identity people, developers) into requirements to have borrowing accessibility having arrived possessions.

Yet another sum for the research means the fresh implication off homes government in the context of cultural assortment in Ghana. The challenge implies that some other ethnic teams consistently resource various other different series tenets applied alongside towards formal. Given this background, its visible regarding books one to even when performs enjoys become over on prospects regarding safer property liberties to belongings and its own effects in Ghana [21,twenty-five,twenty eight,35,47], the challenge stays you to definitely early in the day education tended to swelling other ethnic teams together having study. In such research, the latest crucial distinct features you to change use of casing finance that have got assets on the multiple-cultural ecosystem off Ghana is actually unwittingly glossed over. The new literature signifies that vintage strategies inside the northern Ghana, featuring its diverse ethnic communities, succeed apparently difficult to generalise findings into the entire society. What exactly is critical here’s having small scale training to try to recapture ethnic ramifications to own safer possessions legal rights to help you property and you can exactly how this is exactly put while the financial support.

The current analysis therefore tries to explore the definition regarding property period security for the Tamale (your local capital of Northern Part and you can one of many Dagomba) because the equity for Loans from banks within the homes financialisation

This study seeks to answer the main question: really does certified documents of got property as security help in accessing certified borrowing from the bank to have houses growth in the fresh new Tamale Urban City in the new North Area for Ghana? The newest conclusions associated with studies might possibly be good for the government, creditors, possessions builders, and you may non-political enterprises trying to construction a forward thinking and you will green housing finance system during the Ghana.

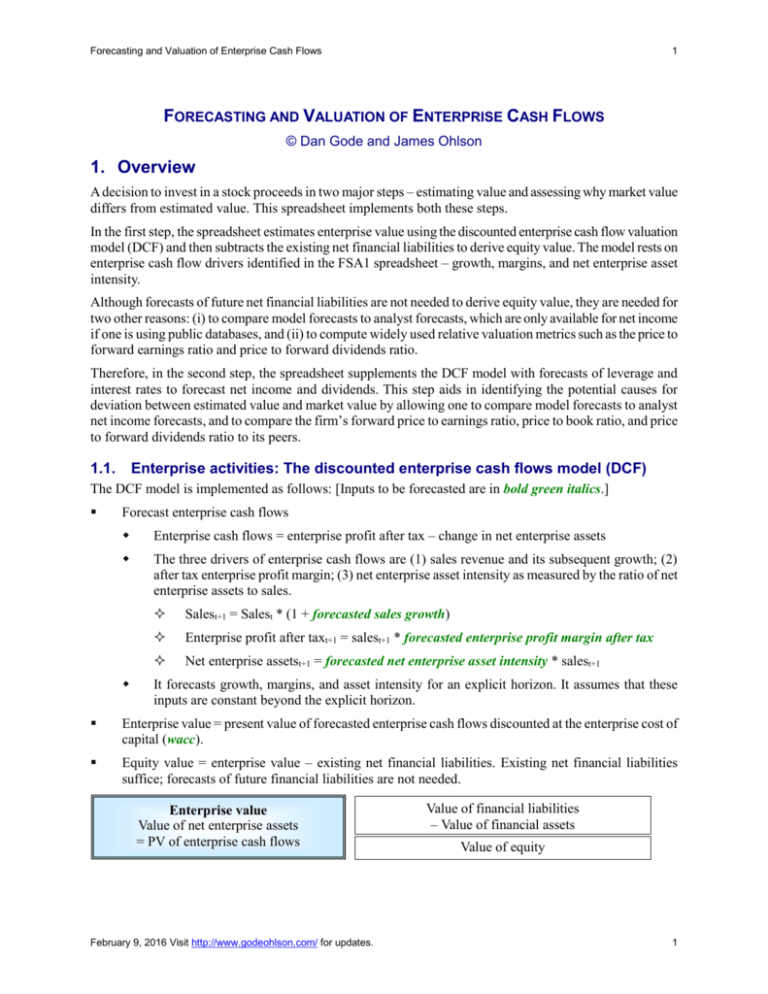

This paper attempts to interrogate the implications from homes term membership getting home shelter as the collateral inside the seeking to Bank loans for the property financialisation throughout the ever before-sprawling city of Tamale. This has effects getting gentrification, ascending housing costs, and you may rising construction value regarding bid to complete-on the shortage Slocomb bad credit payday loans no credit check open 24/7 off property in town. An area-depending approach to financialisation could have been listed generally in the literature just like the a supply of funding [21,25,27,twenty eight,thirty-five,47]. Brand new theoretic structure you to books this research are thus considering assets ideas one to keep the importance of landed possessions as security to access credit to own houses creativity. From inside the much of brand new West industry, the economic check would be the fact property is actually a very important factor off design and therefore thought so you’re able to adhere to factor industry attributes.