Of unique mortgage apps available, probably one of the most beneficial is the Va Financial. Established in 1944 and signed into rules by President Franklin D. Roosevelt, the brand new Virtual assistant mortgage program are, simply speaking, made to honor our very own Experts from the enabling all of them buy otherwise refinance a home. Eligible productive provider members, veterans, as well as their enduring partners meet the requirements when planning on taking benefit of the fresh Va Financial program. Because the its the beginning, the applying possess helped millions of Veterans achieve the Western fantasy. Can it help you as well?

Effective Obligation

- ninety or maybe more days of energetic obligations service while in the war time

- 181 or even more times of active obligations service during the serenity day

Veterans

- ninety or maybe more times of productive responsibility services throughout war-time

- 181 or even more times of productive duty solution during the serenity time

- You were honorably discharged

Reservists

- six several years of services OR 90 or maybe more days of implementation in the a working treat area

- You were honorably released

Partners

- If you’re new thriving spouse out-of a veteran just who died throughout services or as the result of a help-related disability, and also you haven’t remarried

It is simply a brief history of the standards had a need to get a good Va financing. A very full range of qualifications criteria can be acquired on VA’s web site.

As to why a good Virtual assistant Financial?

Whenever inquired about why veterans is to benefit from the Virtual assistant Financial system, Home mortgage Originators at OneTrust Home loans place of work for the Boise, ID provided united states a number of great reasons why. No off. No month-to-month financial insurance. These are simply two of the outstanding benefits one to being qualified army service players are entitled to of the helping our nation. Financing words such as are almost unusual behind closed doors out-of very regulated mortgages.

10 Well-known Mythology In regards to the Va Financial

More 29 million pros and services workers are entitled to Virtual assistant money, but many never completely understand this type of experts. You can find common myths you to end experts out-of providing virtue on the incredible mortgage. Listed below are some of one’s mythology (and positives) associated with that it financing:

Fact: Although experts have put their loan benefits, it can be easy for them to get land once again having Virtual assistant financing playing with leftover or recovered financing entitlement.

Fact: The latest Va has the benefit of many pros and you will functions so you can partners of solution members who are dead or permanently disabled plus household financing.

Fact: New Va mortgage system is mostly about helping pros and you will solution participants buy belongings they live-in seasons-round as his or her number 1 home. This type of are not for choosing vacation house, capital features or other earnings-promoting options. Included in that attention, the new Virtual assistant normally wants your located in the house complete-big date within this 60 days away from closing. That can of course establish challenging for many provider professionals, especially those to your implementation. You will find exclusions with the occupancy criteria, the best being one to a partner is satisfy they with the their behalf.

Fact: It’s true that Va restrictions the brand new closing costs that be paid by the an experienced. Some lenders want the vendor spend the money for non-allowable settlement costs. At the OneTrust you will find possibilities that will allow the fresh veteran so you can generate competitive also provides which do not have to have the vendor to expend extra can cost you.

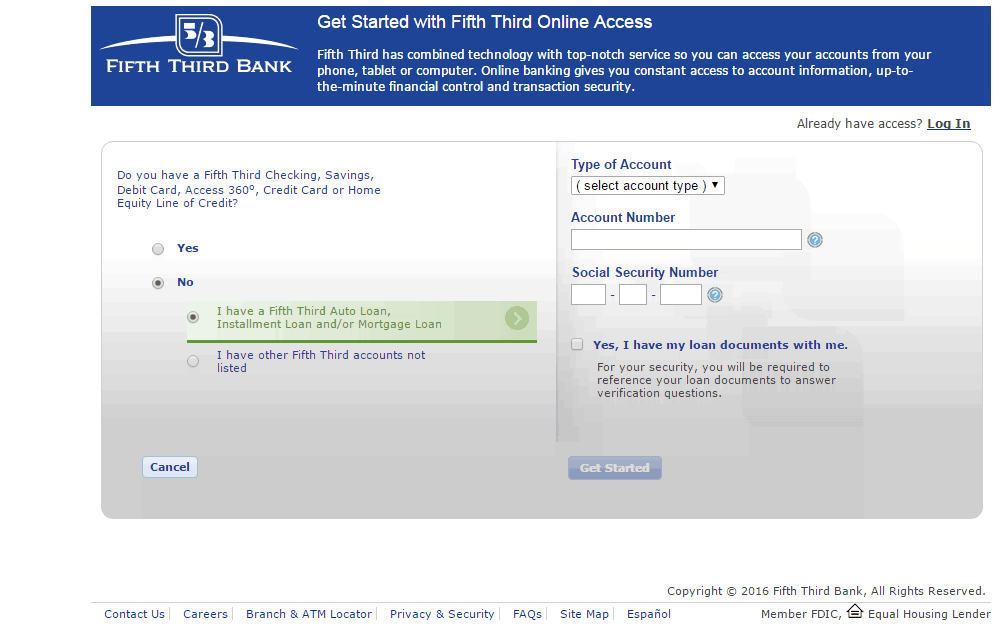

Fact: Certain loan providers need manage the brand new Virtual assistant to find loans acknowledged and you may closed. Within OneTrust, we have been acknowledged so you’re able to individually underwrite all of our Va loans. Ergo, your loan are canned and you will closed from the you without prepared having VA’s acceptance of your credit software, which https://paydayloanalabama.com/black/ means that good Virtual assistant financing usually shuts in identical number of your energy as almost every other mortgage in the OneTrust Home loans.

Fact: Since Va used to be far more strict concerning qualities they’d financing, changes in modern times are making the fresh Virtual assistant conditions similar to the requirements towards FHA and you will Traditional money. The newest VA’s responsibility has been to safeguard brand new veteran to make sure he is to order a good household.

Fact: Much like most other loan applications, the latest Va takes into account the condition of the brand new qualities that they are willing to fund. The house need satisfy an appartment minimal assets criteria, but never matter it out, let’s speak about it earliest!

Fact: Brand new Virtual assistant permits the credit of greater than you to definitely property provided the newest Veteran have adequate qualification. The newest formula is actually complex, however, we are ready to help you determine whether might meet the requirements.

Fact: This new Virtual assistant do accommodate money along side old-fashioned loan restrictions that have a deposit. The level of deposit expected try 25% of difference in the cost and you will max conventional mortgage restriction. Loan limitations alter regularly and you will differ of the condition.

Fact: The latest Virtual assistant financing is one of the most easy loan software when it comes to earlier in the day credit hiccups. We would be happy to talk about your own situation along with you really to determine if you are going to be considered.

While ready to start-off, or you have any inquiries in regards to the Virtual assistant home loans, please give us a call from the (877) 706-5856. All of our experienced mortgage strategists are here so you can!